Patient Support Programs: What Are They and What Do They Offer?

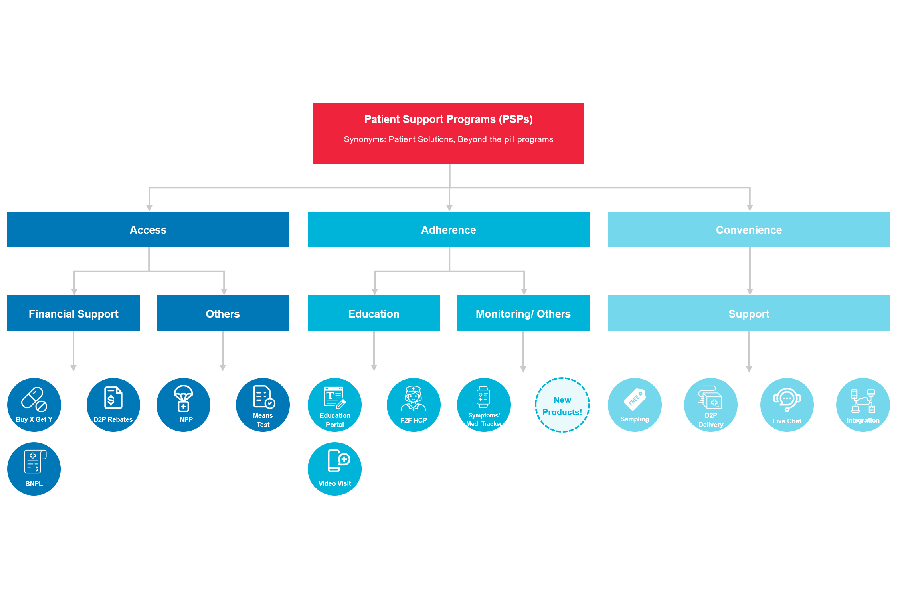

Patient Support Programs (PSPs) – also known by a myriad of names such as patient solutions, patient services or patient assistance programs depending on who you’re speaking to – are “beyond-the-pill” services packaged alongside the clinical profile of a drug, medical device or treatment given to a patient.

Our industry has traditionally been physician- and product-focused. As discussed in the last article, two key forces – mindset and technological shifts – have set in motion the move towards bringing the patient to the center of the care experience.

Important value-added services such as digital therapeutics and remote monitoring are emerging from the rapidly expanding HealthTech arena. As a consequence, traditional service providers are seeing increasing opportunities in adapting to future-looking models for healthcare delivery which are starting to appear, although still rather fragmented.

In this future world, traditional service providers like DKSH will aggregate these value-added yet disjointed solutions churned out by HealthTech startups, using existing scale, and orchestrating a seamless spectrum of digital solutions across the continuum of care for patients.

Towards an improved patient experience

The focus of Patient Support Programs is to address problems patients experience, following a diagnosis or prescription made by a doctor, so patient outcomes can be optimized. In the last ten years, we have observed increasing adoption of some form of PSP as the share of complex treatments has increased (such as monoclonal antibodies (mAbs), tyrosine kinase inhibitors (TKIs), oligonucleotides, cell- and gene-therapies to name a few types!) versus more traditional small molecule drugs.

As biopharmaceutical companies move deeper into the launch of even newer treatment modalities in the realm of cell and gene therapies, comprehensive PSPs (far “beyond-the-pill”) will be required since the role of the “pill” in such cases will likely be to manage known adverse events that accompany such complex therapies.

The first generation of PSPs

To date, the bulk of the programs offered by the biopharmaceutical and medical device firms in Asia are related to patient affordability or financial assistance. Many expensive drugs such as mAbs in markets across Southeast Asia have Patient Access Programs (PAP) that apply a “Buy X Get Y Free” promotional model for patients out-of-pocket.

These initiatives, although seemingly as simple on paper as a shampoo promotion at your local convenience store, require complex workflows to handle the controls built into the redemption programs to mitigate the risk of fraud along the value chain. The industry is heavily regulated and the prices of the goods at stake could in some cases add to a lifetime cost of shampoo and body wash.

A handful of biopharmaceutical and medical device companies have been running more novel approaches, such as means-testing patients to distinguish between patients’ ability to afford the drug treatment rather than offering a uniform program regardless of ability to pay.

Improving patient adherence

Aside from addressing the problem of affordability, we are seeing companies attempt programs targeted at the problem of adherence. The concept of services or after-sales support is well understood in industries such as automotive, eCommerce and industrial machinery, however, is still a novel idea for the pharmaceuticals industry.

We are still in the early days and there is a lot of progress to be made in delivering tailored programs to solve the unmet needs of patients, doctors and caregivers. Assisting all stakeholders in the treatment process to complete their jobs-to-be-done delivers tremendous value. We will discuss more about these unmet needs in the next article.

As research and development (R&D) groups in Boston, Basel and South San Francisco develop better treatments with improved efficacy end-points and safety profiles for patients, the business units (BUs) in Asia should evolve from the traditional focus on selling, marketing or medical communications along the attributes of their brands and allocate more resources to solving the patients’, doctors’ and stakeholders’ problems, above and beyond what their drugs or devices can do alone.

The endgame of the BU should be to improve doctor and patient engagement and ensure improved outcomes through PSPs that complement the clinical profile of existing treatments until R&D groups develop next-generation assets. A secondary goal of the BU should be to collect real-world data to loop back to R&D and guide the clinical development process for treatments of the future.

This should be the modus operandi for biopharmaceutical and medical device companies to maximize the value of their existing brands; continuously improve the productivity of their R&D in focus therapy areas. In other words, brand positioning for BUs should include service packages that complement and enhance traditionally measured dimensions of efficacy and safety against their competitors’ brands. This total approach offers the patient the best outcomes they need and deserve.

Source: